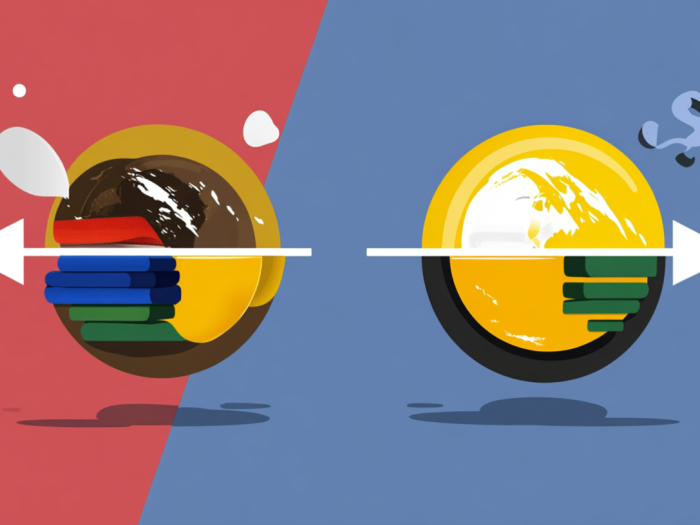

When tackling debt, two popular strategies often come up: the debt snowball and the

debt avalanche. Both methods aim to help you become debt-free, but they approach

the process differently. This article compares the debt snowball and debt avalanche

methods to determine which one pays off debt faster and which might be the better

fit for you.

Understanding the Debt Snowball Method

The debt snowball method focuses on paying off debts from smallest to largest, regardless of interest rate.

How it Works:

- List all your debts from smallest balance to largest.

- Make minimum payments on all debts except the smallest.

- Put any extra money toward paying off the smallest debt as quickly as possible.

- Once the smallest debt is paid off, add that payment amount to the minimum payment of the next smallest debt, and so on.

Pros:

- Provides quick wins, which can be motivating.

- Psychologically easier to stick with for some.

Cons:

- May take longer to pay off overall debt due to ignoring interest rates.

- Can be more expensive in the long run.

Understanding the Debt Avalanche Method

The debt avalanche method focuses on paying off debts with the highest interest rate first.

How it Works:

- List all your debts from highest interest rate to lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Put any extra money toward paying off the debt with the highest interest rate as quickly as possible.

- Once the highest interest rate debt is paid off, move on to the debt with the next highest interest rate, and so on.

Pros:

- Saves the most money on interest.

- Pays off debt faster overall.

Cons:

- May take longer to see initial progress.

- Requires more discipline.

Debt Snowball vs. Debt Avalanche: Which Pays Off Debt Faster?

Mathematically, the debt avalanche method pays off debt faster. By prioritizing high-interest debts, you minimize the amount of interest accruing over time, leading to a quicker overall payoff.

Which Method is Right for You?

The “faster” method isn’t always the “best” method. Consider these factors:

- Motivation: If you need quick wins to stay motivated, the debt snowball might be better.

- Discipline: If you’re highly disciplined, the debt avalanche will save you more money and time.

- Financial Situation: If you’re facing high-interest debts, the avalanche method is often the smarter choice.

Using a Debt Calculator

A debt calculator can help you visualize the difference between the two methods. Input your debt information (balance, interest rate, minimum payment) and compare the payoff timelines and total interest paid for each strategy.

Conclusion

While the debt avalanche method technically pays off debt faster and saves you more money on interest, the debt snowball method can be a powerful motivator. Choose the method that best aligns with your personality, discipline level, and financial situation. Regardless of the method you choose, consistency and commitment are key to achieving debt freedom.

Related Keywords

Debt snowball, debt avalanche, debt payoff, debt reduction, debt management, pay off debt fast, debt free, budgeting, financial planning, debt calculator.

Frequently Asked Questions (FAQ)

1. What is the debt snowball method?

The debt snowball method focuses on paying off debts from smallest balance to largest, regardless of interest rate.

2. What is the debt avalanche method?

The debt avalanche method focuses on paying off debts with the highest interest rate first.

3. Which method saves more money on interest?

The debt avalanche method saves more money on interest because you pay off high-interest debts faster.

4. Which method provides quicker motivation?

The debt snowball method provides quicker motivation by delivering small wins as you pay off smaller debts.

5. Which method is mathematically faster?

The debt avalanche method is mathematically faster because it minimizes the amount of accruing interest.

6. What factors should I consider when choosing a method?

Consider your motivation level, discipline, and overall financial situation, especially the interest rates on your debts.

7. Can a debt calculator help me decide?

Yes, a debt calculator can help you visualize the payoff timelines and total interest paid for both methods.

8. Is the debt snowball method always a bad choice?

No, the debt snowball method can be a good choice for those who need the psychological boost of early success to stay committed.

9. Is the debt avalanche method always the best choice?

While mathematically optimal, the debt avalanche method requires discipline and might not be suitable for everyone who needs quick wins.

10. What is the most important factor in paying off debt?

Consistency and commitment are the most important factors, regardless of the method you choose.