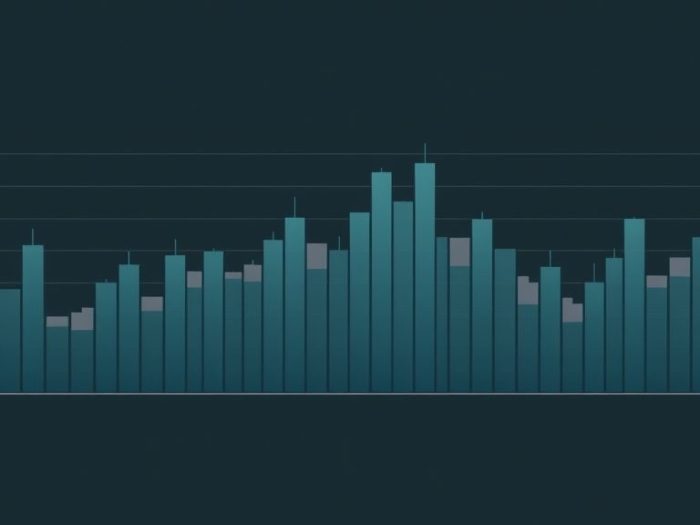

Volume Profile is a powerful charting tool that displays trading volume at specific price levels

over a specified period. Algorithmic trading strategies can leverage Volume Profile data to

identify high-probability trading zones. This article explores how to use Volume Profile algorithms

for improved trade entries and exits.

Understanding Volume Profile

Volume Profile provides a horizontal histogram on a price chart, showing the volume traded at

each price level. Key components include:

- Value Area (VA): The price range where the majority (typically 70%) of the volume occurred.

- Point of Control (POC): The price level with the highest trading volume within the Value Area.

- High Volume Nodes (HVNs): Price levels with significant trading volume.

- Low Volume Nodes (LVNs): Price levels with relatively low trading volume.

Why Use Volume Profile in Algorithmic Trading?

Volume Profile helps identify:

- Support and Resistance: High Volume Nodes often act as support or resistance.

- Value Areas: Price is likely to trade within the Value Area.

- Breakout and Breakdown Points: Low Volume Nodes can be breached more easily.

- Market Acceptance: The Point of Control indicates the price level where the market has found the most agreement.

Building Volume Profile Algorithms

1. Data Acquisition

Obtain historical price and volume data that includes volume information at each price level.

2. Volume Profile Calculation

Calculate the Volume Profile for a specific period (e.g., daily, session).

3. Identify Key Levels

Develop algorithms to identify:

- Value Area High (VAH)

- Value Area Low (VAL)

- Point of Control (POC)

- High Volume Nodes (HVNs)

- Low Volume Nodes (LVNs)

4. Entry and Exit Rules

Define trading rules based on Volume Profile levels. Examples:

- Long Entry: Buy when the price bounces off a High Volume Node within the Value Area.

- Short Entry: Sell when the price fails to break above the Value Area High.

- Take Profit: Set at the next High Volume Node or the opposite end of the Value Area.

- Stop Loss: Place below a High Volume Node for long trades or above for short trades.

5. Backtesting

Thoroughly backtest the algorithm on historical data to evaluate its performance.

Example: Volume Profile Breakout Strategy

- Condition: Identify a Low Volume Node (LVN) above a Value Area.

- Entry: Buy when the price breaks above the LVN.

- Take Profit: Set at the next High Volume Node.

- Stop Loss: Place below the Value Area High.

Important Considerations

- Timeframe: The effectiveness of Volume Profile can vary across different timeframes.

- Volume Data Accuracy: Use reliable and accurate volume data.

- Market Conditions: Volume Profile may be less effective in strongly trending markets.

- Parameter Optimization: Carefully optimize parameters for Value Area calculation and other settings.

- Computational Resources: Calculating and analyzing Volume Profile data can be computationally intensive.

Conclusion

Volume Profile algorithms offer a powerful way to identify high-probability trading levels.

However, they require careful implementation, thorough backtesting, and a good understanding of

market dynamics.

Related Keywords

Volume Profile, algorithmic trading, options trading, stock trading, forex trading, trading

algorithms, trading indicators, price action, market analysis, trading strategy.

Frequently Asked Questions (FAQ)

1. What is Volume Profile?

Volume Profile is a charting tool that displays trading volume at specific price

levels over a specified period.

2. What is the Value Area (VA)?

The Value Area is the price range where the majority (typically 70%) of the trading

volume occurred.

3. What is the Point of Control (POC)?

The Point of Control (POC) is the price level with the highest trading volume within

the Value Area.

4. What are High Volume Nodes (HVNs)?

High Volume Nodes (HVNs) are price levels where a significant amount of trading

volume occurred.

5. What are Low Volume Nodes (LVNs)?

Low Volume Nodes (LVNs) are price levels where relatively little trading volume

occurred.

6. How can Volume Profile be used to identify support and resistance?

High Volume Nodes often act as support or resistance levels, as they represent

price levels where there’s significant buying or selling interest.

7. What is the significance of the Point of Control (POC)?

The Point of Control indicates the price level where the market has found the most

agreement on value. Price often gravitates towards the POC.

8. How can Volume Profile help identify breakout or breakdown points?

Low Volume Nodes can be breached more easily, making them potential breakout or

breakdown points.

9. What are the key steps in building a Volume Profile trading algorithm?

Key steps include data acquisition, Volume Profile calculation, identification of

key levels (VAH, VAL, POC, HVNs, LVNs), entry and exit rule definition, and

backtesting.

10. What are the limitations of using Volume Profile algorithms?

Limitations include potential variations in effectiveness across different

timeframes, the need for accurate volume data, and potential reduced effectiveness in

strongly trending markets.